Trending Now

MARKET NEWS

Eurex, Cboe end 2025 with record credit futures OI despite December volume pullback

In December, CME’s US dollar credit futures traded US$400 million in average daily volume ( ADV) with US$541 million in open interest (OI), Cboe’s iBoxx iShares suite printed US$148 million ADV and...

MUFG consolidates European banking operations

Mitsubishi UFJ Financial Group (MUFG) is merging its European operations, creating a universal banking platform.

MUFG Securities (Europe) will become part of MUFG Bank (Europe),...

Etrading Software submits CTP authorisation

Etrading Software is one step closer to running the UK’s bond consolidated tape, submitting its authorisation application to the Financial Conduct Authority.

The High Court’s...

Mark Whirdy joins Mediolanum International

Mediolanum International Funds is an Irish asset management, offering 65 funds which it reports hold €70.8 billion in assets under management as of December 2024.

He joins from Robeco.where he spent more than...

Vizioz swaps Sculptor for Elmwood

Philippe Vizioz has joined Elmwood Asset Management as a European credit trader.

Elmwood holds US$23 billion in assets under management, specialising in alternatives across global...

Dimensional promotes in US and APAC

Dimensional Fund Advisors has promoted Julian Aziz as a senior trader in California and Archit Soni as a senior portfolio manager in Singapore.

Dimensional holds...

FEATURES

Human battles machine in JGB market

Participants say electronic trading of Japanese government bonds has reached an inflection point, but others counter that the death of voice trading has been...

Credit futures see OI and ADV increase more than sevenfold YoY

The adoption of credit futures as a mainstream credit trading vehicle is broadening across venues and currencies: US$ iBoxx total return based futures traded...

Trade size growth undercuts European bond market ‘equitification’

Since 2023 European corporate bond markets have seen trades size grow, as trading platforms report increasing volumes

“If we break down electronic trading growth in European...

The pretenders, and kingmakers, to the bond throne

Dealers are backing several new trading platforms who are fighting major incumbents for market share.

In the bond market, the trading platform landscape has been...

PROFILES

RESEARCH

Bond traders predict data science/AI use explosion in 2026

The DESK’s Corporate Bond Liquidity Access Survey, supported by LTX, finds trading desks are on the cusp of change.

Buy-side traders see 2026 as a turning...

Subscriber

Credit Spotlight

FROM THE ARCHIVES

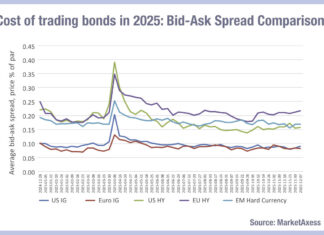

Bid-ask spread volatility highest in US bond markets

When comparing liquidity across markets in 2025, buy-side bond traders may consider European investment grade markets to have an optimal set of characteristics. However,...

EIB’s Project Venus issues second digital bond on blockchain

The European Investment Bank (EIB) — in collaboration with Goldman Sachs Bank Europe, Santander and Société Générale — launched Project Venus, their second euro-denominated...

Cross-asset TCA is viable in credit markets

Can transaction cost analysis (TCA) provide an apples-for-apples comparison of buy-side trading costs across different asset classes? Imposing a single measurement framework across markets...

FILS USA: The roadblocks to electronic fixed income trading

Fixed income markets moving toward electronic trading has been a recurring theme in the industry for a number of year, but there are roadblocks...

BlackRock launches first BuyWrite fixed income ETFs

BlackRock launched a first-of-its-kind suite of fixed income ETFs that provide access to buy-write investment strategies on baskets of fixed income securities: the iShares...

On The DESK: Divide and conquer

The DESK interviews the team delivering continuous management of trading, for the world’s largest collective assets under management.

• Dan Veiner is Co-Head of Global...

Agency Broker Hub : A look under the broker review hood

In this Agency Broker Hub column, Michelangelo Gigante, head of Execution Desk at Eurizon Capital SGR and Gherardo Lenti Capoduri, head of Market Hub,...

Pumped up projections: The Arizona gym muni fraud

The SEC has filed charges against three Arizonian individuals, alleging they defrauded investors by falsifying revenue documents for a US$284 million municipal bond issuance...

Sidi Shatku poached by BofA

SMBC’s former head of Emerging Markets (EM) Credit Trading in Europe, Middle East and Africa (EMEA), Sidi Shatku, has joined BofA’s EM credit trading...

Karen Karniol-Tambour named co-chief investment officer at Bridgewater

Nir Bar Dea, co-chief executive officer at Bridgewater has confirmed that Karen Karniol-Tambour is now co-chief investment officer of the firm, joining Bob Prince...

The reward of risk

By Larry E. Fondren, Founder & CEO, DelphX Capital Markets Inc.

Traditional risk/reward comparisons treat the effective cost of an investment’s risk as a decrement...

Lead: Bloomberg throws down the gauntlet

Bloomberg’s new pricing model for bond trading – if accepted as delivering value – will pay for development of new functionality.

Competition between the big...