MARKET NEWS

IOSCO sets pre-hedging guard rails, amid calls for ban

The International Organisation of Securities Commissions (IOSCO), has published its final report on pre-hedging, amid call for the practice to be banned, and allegations...

Yield Book data made available through Finbourne’s LUSID

LSEG’s Yield Book fixed income data and analytics will be available in Finbourne Technology’s Liberated Unified Secure Investment Data-machine (LUSID) data management platform from...

MarketAxess launches FI opening and closing auctions

MarketAxess is launching opening and closing auctions for US credit “in the coming weeks”.

Opening and closing auctions have long been available in equity and...

Chainlink collaborates with Tradeweb, UBS

Chainlink is capitalising on the industry’s growing demand for tokenisation and on-chain operations, announcing a data partnership with Tradeweb and completing the first live...

Clearstream offers tokenised issuance in D7 expansion

Deutsche Borse’s Clearstream has launched a tokenised securities platform, designed to handle issuance and management.

D7 DLT facilitates the issuance of central securities depository regulation...

Singhal swaps SMBC for Mizuho

Shrey Singhal has joined Mizuho as director of USD investment grade credit trading.

Based in New York, Singhal specialises in insurance and asset managers and...

FEATURES

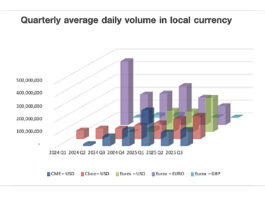

Credit futures see OI and ADV increase more than sevenfold YoY

The adoption of credit futures as a mainstream credit trading vehicle is broadening across venues and currencies: US$ iBoxx total return based futures traded...

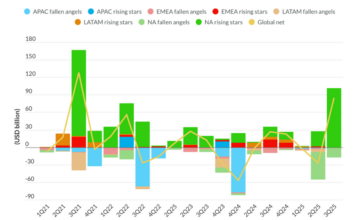

Trade size growth undercuts European bond market ‘equitification’

Since 2023 European corporate bond markets have seen trades size grow, as trading platforms report increasing volumes

“If we break down electronic trading growth in European...

The pretenders, and kingmakers, to the bond throne

Dealers are backing several new trading platforms who are fighting major incumbents for market share.

In the bond market, the trading platform landscape has been...

Declaration of dependence

US president to oversee financial institution regulation amid deregulation drive.

Executive orders signed by US president, Donald Trump, have given him oversight of all US...

PROFILES

RESEARCH

Bond traders predict data science/AI use explosion in 2026

The DESK’s Corporate Bond Liquidity Access Survey, supported by LTX, finds trading desks are on the cusp of change.

Buy-side traders see 2026 as a turning...

Subscriber

Credit Spotlight

FROM THE ARCHIVES

Henriques poached by HilltopSecurities

HilltopSecurities has named Drew Henriques co-head of High Yield Municipal Trading, having poached him from Citi. He had been a high yield municipal trader...

Interactive Brokers extends trading hours for US Treasuries

Interactive Brokers, an automated global electronic broker, has expanded trading hours for US Treasury bonds on its platform, allowing the firm’s global clients to...

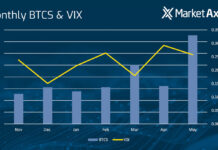

The Loan Lowdown: Volatility’s impact on Leveraged Loans

Howard Cohen, Head of Leveraged Loans at MarketAxess.

Since early April, the leveraged loan market has trended in one direction. Risk assets have continued to...

FILS 2022: FlexTrade, Glimpse herald “transformative” EMS data integration

Bond market data sharing platform Glimpse Markets has integrated with FlexTrade Systems’ fixed income execution management system (EMS), the two companies have announced.

FlexTrade said...

OMS, EMS or something in between?

Many firms are considering merging their order management systems (OMSs) and execution management systems (EMSs), but oversimplification could be counterproductive, delegates at this year’s...

The Agency Broker Hub: The hybrid approach in fixed income brokerage

The hybrid approach in fixed income brokerage - How brokers better comply with clients’ execution models.

Umberto Menconi, head of Digital Markets Structures, Market Hub, Banca IMI,...

US credit issuance tailing off over summer?

June 2024 has seen US corporate bond issuance levels only slightly higher than those seen in June 2023, after record levels at the start...

Why repo will not crash again

In December 2016 Europe’s repo markets crashed and burned. This year may look healthier than last but finding liquidity can still prove challenging. Lynn...

Sovereigns may be downgraded due to climate change

There could be a significant economic impact on the 25 countries in the FTSE World Government Bond Index (WGBI) by 2030 due to the...

Paul Mutter takes major fixed income role at TD Securities

Following a string of recent high profile ex-Goldman appointments across the industry, TD Securities has tapped Goldman veteran Paul Mutter as managing director, head...

Etrading Software to provide UK bond CT

Etrading Software has been awarded the consolidated tape provider (CTP) contract in the UK.

The £4.8 million contract (£4 million excluding VAT) is estimated to...

European Women in Finance 2022 – The Longlist

In 2020, Best Execution and The DESK hosted the first European Women in Finance Awards, following the model of Markets Media's long-established awards programme....